Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

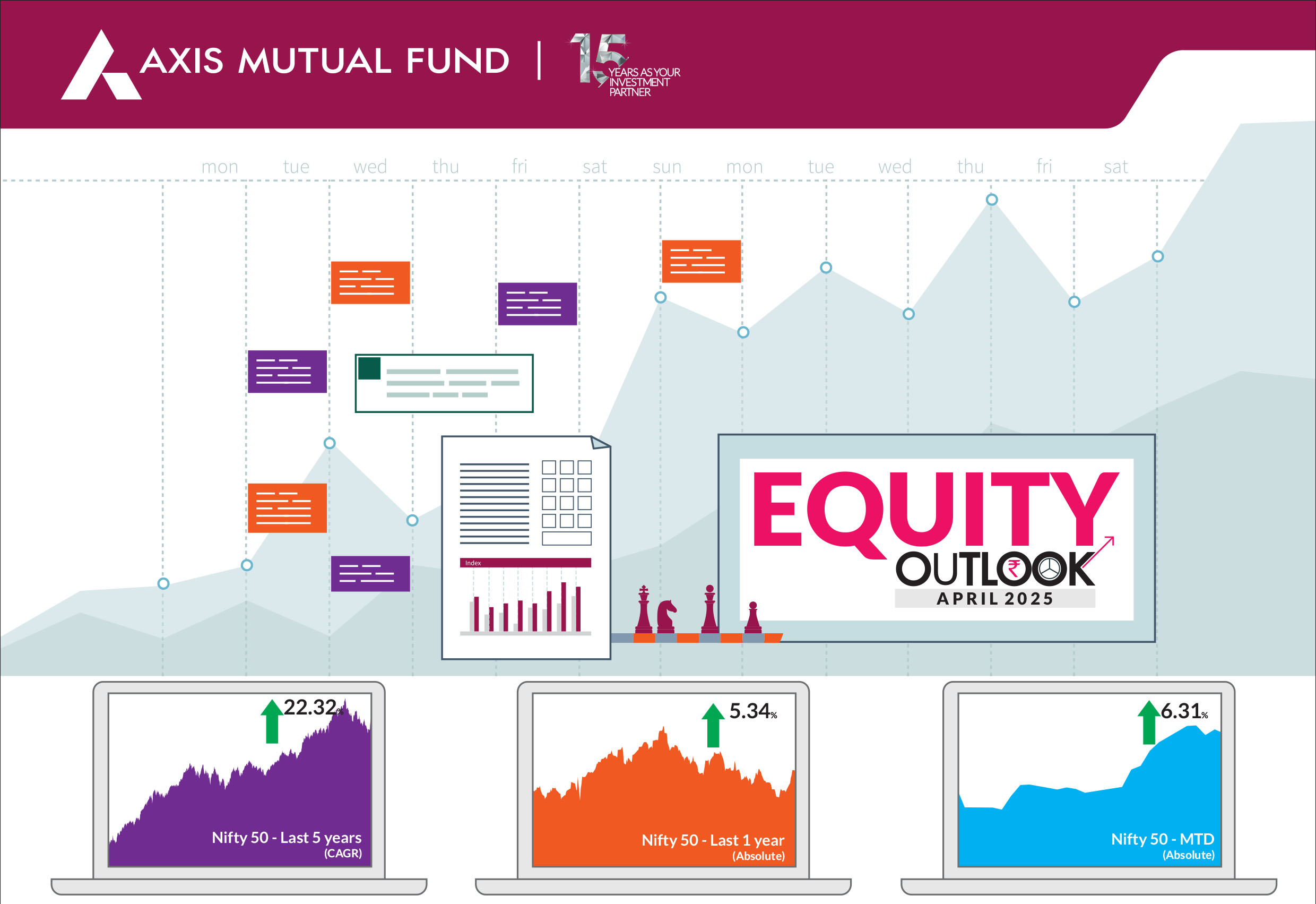

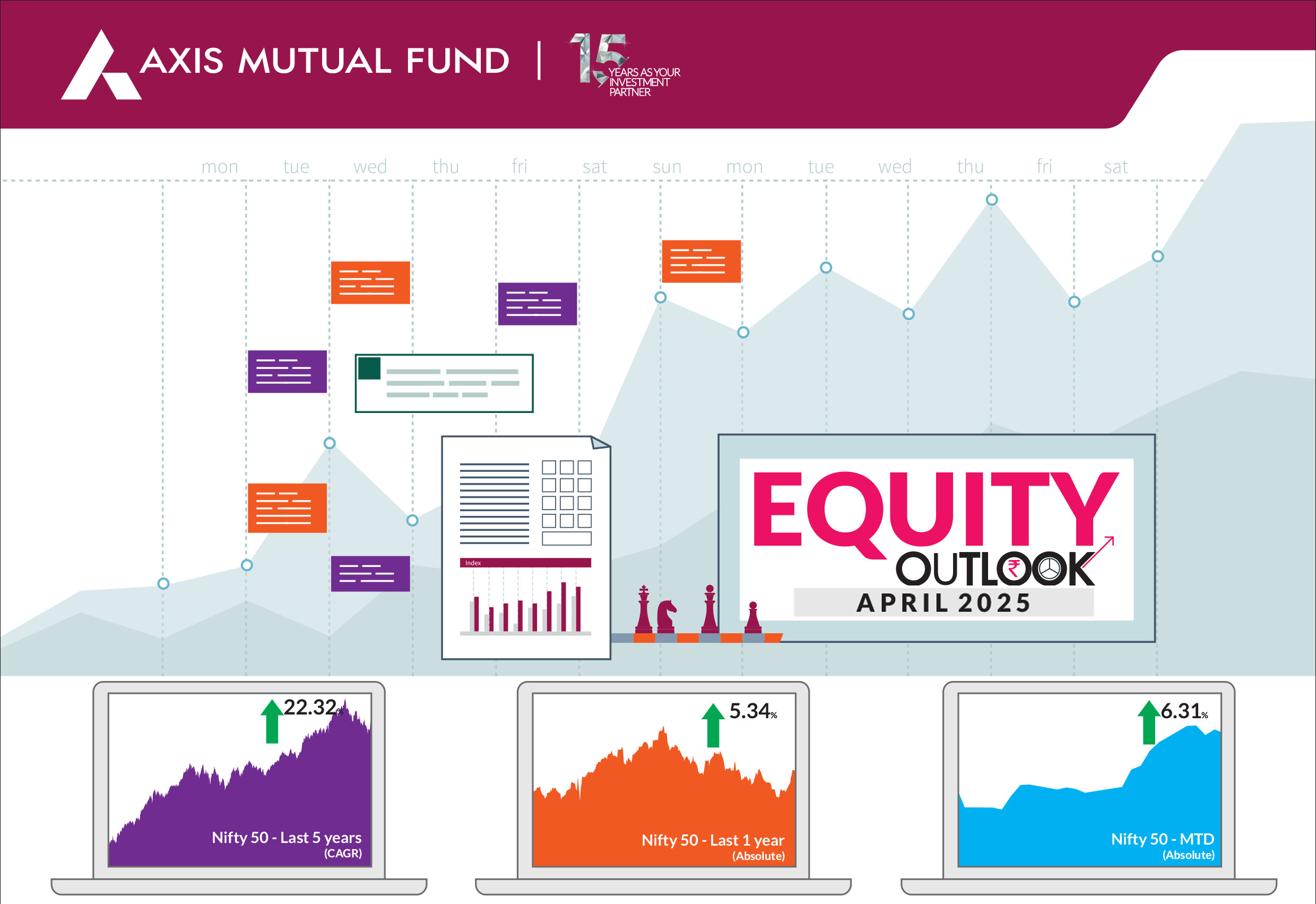

March was a month of RRR - Rise, Recover and Return of foreign inflows albeit to a small extent. Earlier in the month, investor sentiment remained cautious due to lingering concerns about the potential impact of the tariffs by the US and their consequences globally. However, sentiment improved after the US Federal Reserve indicated two rate cuts this year. Consequently, after five months of negative returns, Indian equities ended March higher. The BSE Sensex and Nifty 50 closed 5.7% and 6.2% higher, while the NSE Midcap 100 advanced by 7.7% and the NSE Smallcap 100 by 9.3%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in March but the extent of outflows reduced to US$0.4 bn. In fact, the last 5-6 sessions saw good inflows primarily on account of attractive valuations, an appreciation in the rupee and somewhat strong macro environment. In contrast, DIIs bought equities worth US$ 4.3bn. With this the total outflows by FPIs in FY25 stand at US$13.4 bn while the total inflows by DIIs add upto US$71.6 bn. |

|

Going forward, tariff war and uncertainty related to it could be a key trigger for global and Indian markets. In particular, reciprocal tariffs have been announced across countries with tariff on India being 26% which means all goods entering the US will now attract a minimum 26% levy effective April 5, 2025. The impact on India's exports may be muted in near-term but global growth and trade slowdown will be negative for India over the medium-term. Sectors such as chemicals, electronics, gems and jewelry, etc. face a relatively larger increase in tariffs while pharmaceuticals have been kept out of the ambit of tariffs. India's export to the US is dominated by textiles (furnishings and apparels), gems and jewelry (diamonds), pharmaceutical products (medicaments), electronics (mobile phones). Earlier, at an aggregate level, the difference between India imposed and US imposed tariff rates ranged between 6-10% for major exports. After the reciprocal tariffs, most sectors (except pharma and energy) will uniformly face tariff rates at 26%. The steeper additional tariffs impact major US trading partners, with the European Union facing a 20% and China a 34% in addition to the existing 20%. Other key partners include South Korea at 25%, Japan at 24% and Vietman at a steep 46%. These reciprocal tariffs are only half the rate that other countries impose on US products and this leaves room for negotiation. Last month, we spoke about how the market correction (15-25% for various indices) has brought Nifty valuations closer to their one-year forward PE average. Following the underperformance, the India premium has also adjusted and is now much closer to the average compared to other emerging markets. We believe that markets may remain rangebound in the near term and the lingering effect of tariffs may continue to dominate market sentiment. At Axis, we consistently emphasize that markets are not unidirectional, making it crucial to stay invested to capitalize on any declines. The rally in March serves as a prime example. Long-term wealth growth is best achieved through an asset allocation approach and diversified investments across various types of funds. We believe that the economic challenges faced by us may have troughed; brent crude is lower, headline inflation is below central bank's 4% target and we may see further lower rates. While we cannot control external factors such as tariffs, their impact on countries including India, and geopolitical uncertainties, we can manage risks by ensuring our portfolio construction is geared towards capturing growth tailwinds in various sectors-both structural and opportunistic. This approach helps build a portfolio that is well-positioned to weather uncontrollable risks at any given time. Near-term market volatility is expected to continue, driven by both global and domestic uncertainties. In the current scenario, we believe that earnings growth is unlikely to support valuation expansion in the near term. In this market, the high growth sectors and companies have well appreciated and consequently substantially re-rated, wherein we carry valuation risk. On the other hand, the companies which have not been substantially re-rated tend to carry growth risk, as growth has been weak in them. Close to two thirds of rise in small and midcap names since March 23 was valuation re-rating and earnings growth contributed to only one third of the increase. While valuations are beginning to make sense in pockets, they still remain elevated relative to historic context and one has to anyways assess this in relation to future prospects. In terms of sectors, we have been increasing exposure to financials, particularly NBFCs and pharma, we remain overweight the consumer discretionary segment through retailers, hotels, travel and tourism and have reduced our overweight in automobiles and remain underweight information technology. Renewable capex, manufacturers and power transmission/distribution companies, defense are the other themes we favour. If one views India's long term growth story, the fundamentals are supported by: 1) strong macro stability, characterized by improving terms of trade, a declining primary deficit, and declining inflation 2) annual earnings growth in the mid- to high-teens over the next 3-5 years, driven by an emerging private capital expenditure cycle, the re-leveraging of corporate balance sheets, and a structural increase in discretionary consumption. |

Source: Bloomberg, Axis MF Research.